[SMM Hot Topic] Excellent Performance in the Automotive Industry's "Mid-Year Exam"

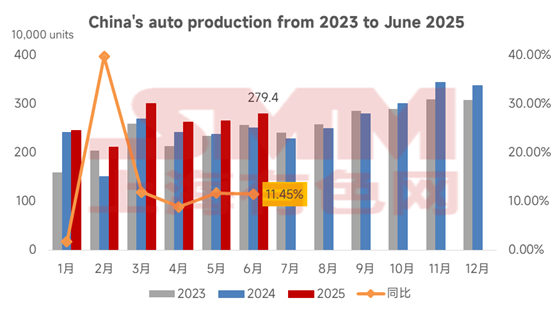

From January to June, auto production and sales reached 15.621 million units and 15.653 million units respectively, with YoY growth rates of 12.5% and 11.4%. The production growth rate narrowed by 0.2 percentage points compared to January-May, while the sales growth rate expanded by 0.5 percentage points. In the first half of 2025, auto production and sales both exceeded 15 million units for the first time, achieving a high growth rate of over 10% YoY!

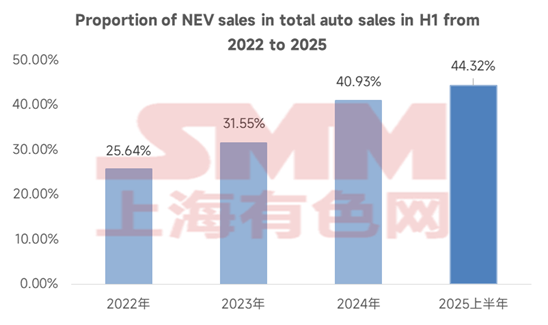

From January to June, NEV production and sales reached 6.968 million units and 6.937 million units respectively, with YoY growth rates of 41.4% and 40.3%. Exports surged by 75.2% YoY, demonstrating the strong resilience and vibrant vitality of China's economy. Riding on the wave of policies such as trade-in, NEV consumer demand continues to rise. In the first half of the year, NEV new car sales accounted for 44.3% of total new car sales, with newly registered NEVs increasing by 27.86% YoY. Comparing with historical data, NEVs' share in total auto sales is growing, indicating that the growth in NEV consumption not only highlights the great potential of domestic demand but also reflects new consumption trends.

In the first half of the year, the domestic auto market significantly improved, driven by the continued effectiveness of the auto trade-in policy, achieving a YoY growth rate of over 10%. NEVs maintained their rapid growth momentum, with an increased market share, driving the accelerated transformation and upgrading of the industry. This news highlights the supporting role of domestic market improvement in the overall growth of the auto market, with NEVs becoming a key driving force for leading the transformation. The association pointed out that the policy effects and new energy trends are reshaping the industry landscape. Looking ahead to the second half of the year, the orderly implementation of the "program of large-scale equipment upgrades and consumer goods trade-ins" policy, combined with the rich supply of new products from enterprises, will boost consumption growth and support the healthy and stable operation of the industry.

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), and SMM legally enjoys complete copyright and related intellectual property rights.

The copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights of all content contained in this report (including but not limited to information, articles, data, charts, pictures, audio, video, logos, advertisements, trademarks, trade names, domain names, layout designs, etc.) are owned or held by SMM or its related right holders.

The above rights are strictly protected by relevant laws and regulations of the People's Republic of China, such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, and the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, disseminating);

2. Disclose the content of this report to any third party;

3. License or authorize any third party to use the content of this report;

4. For any unauthorized use, SMM will legally pursue the legal responsibilities of the infringer, demanding that they bear legal responsibilities including but not limited to contractual breach liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

Data Source Statement:

(Except for publicly available information, other data in this report are derived from publicly available information (including but not limited to industry news, seminars, exhibitions, corporate financial reports, brokerage reports, data from the National Bureau of Statistics, customs import and export data, various data published by major associations and institutions, etc.), market exchanges, and comprehensive analysis and reasonable inferences made by the research team based on SMM's internal database models. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final interpretation right of the terms in this statement and the right to adjust and modify the content of the statement according to actual circumstances.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)